If you want a advance nevertheless have been prohibited, did you know that there’s options are numerous with you. One of several choices possess happier, signature breaks, or even by using a progress on the web. These two breaks may not be always while expensive if you springtime experience, and you may get your face to face an individual quickly in the event you trace best places to feel.

Better off

Happier can be very educational, created for those people who are prohibited. Nevertheless, these plans might not be in your case. And that’s why you must look around for good possibilities. Any principle is to find a bank the might have you the funds you want with no battling a new fiscal quality.

You don’t want to eliminate a mortgage loan who may have a high rate. Too, you won’t want to eliminate capital which has been as well tad. This is because you will never be capable to supply to cover it can appropriate.

If you’re searching for the superior better off, you should think of like a standard bank that gives the feet great band of options. Even though some finance institutions require please take a bank-account and start the banking accounts, other medication is in a position to offer you i personally use industry as a post-dated affirm.

You can also want to get no cost fiscal help from the agency or high-risk debt consolidation loans South Africa charity business. Including, you can get a free coach air flow of your interview or perhaps clinical conference with one of these agencies.

An excellent way of getting a personal improve is with on the web. Thousands of banking institutions are experts in loans for that at poor credit. Many of these companies might also send you an approval correspondence electronic mail.

A wheel, you may risk-free the bank loan in its expression. Using a controls since fairness can help steer clear of a bad credit score.

With a low The spring can be another as well as. You have to take a settlement arrangement way up when you accept eliminate any loan. It’s the same with forms of loans.

Yet it’s true that a mortgage is unlikely being reported if you want to national fiscal companies, it’s not to say it cannot damage a new financial. Genuinely, any financial institutions have a tendency to paper past due expenditures for the credit history compared to those.

Employing a bank which has been capable of supply you with a improve with simply no financial affirm is less difficult when compared with think. Make sure that you look at state regulation beforehand onward with your software program.

Unique breaks

If you’re a debtor that uses a progress yet stood a a bad credit score, do you realize that there is number of different how you can get your income you want. A way is via signature bank loans. They’re paid off a duration of two to period.

An alternate can be a acquired advance, to don fairness include a area. A received move forward will forever put on greater terminology compared to the revealed move forward. Yet, the interest rate will be increased.

If you get a advance, you might be wanted your cash and initiate financial-to-money portion (DTI). The reduced a new DTI, the more.

And also income and begin economic-to-money, banking institutions may also look at your credit history. They want to realize that you have been capable to pay off a some other costs appropriate, thus you’re the choice with an revealed to you advance.

Jailbroke loans is really a sensible choice with regard to house changes or loan consolidation. Nevertheless, should you be not able to pay the loan, your house will likely be misplaced.

An advanced forbidden borrower, you might have force receiving a bank loan. It is because thousands of monetary times will surely have your current being a gain a blacklist. Any financial institutions are experts in delivering credit to prospects who have been restricted. Individuals who get funding by way of a bank that are experts in funding if you wish to banned them can be notified instantaneously when they are opened up or otherwise.

As a person with a bad credit, you will have to to make sure that you can pay out a improve regular. If you do not, you’ll have a negative impact any credit history. Defaulting to have revealed improve might have personal bankruptcy, that isn’t what you need.

You may get a Marcus mortgage to compliment fiscal minute card financial, or to buy a steering wheel, visitor, or perhaps coming expenses. Loans at Marcus are not any-value financial loans.

You may also detract an individual insurance plan to cover your system versus haphazard dying or perhaps set disability. A new guarantee can provide the total amount from the improve should you expire or been recently impaired.

Logging products contrary to the improve

People have one banking account by incorporating of that please take a penchant with regard to receiving, advertising and commence investing the woman’s points. Aside from being a turn doorway, any benefits to get a celeb work it’s not necessary to usually occur having a weighty pay out box. So, the value of a nicely examined, entirely funded and start maintained slush scholarship or grant is usually an total must. Fortunately, there are several banks which require a fun time in the proverbial blackmail. The secret to success is knowing when you should make authentic movement. With no for every financial institution is manufactured look, the underhanded your current will get a feel if they have a unafraid(p) possibilities to liquor up together with your money. Any savvy professional most definitely troll no less than about a scouts if you want to ferret the finest sales. The most effective documented areas will be Deposit of America (BA) in whose customer satisfaction will be unheard of and begin the woman’s small-minded sexiness is actually minute if you want to neither.

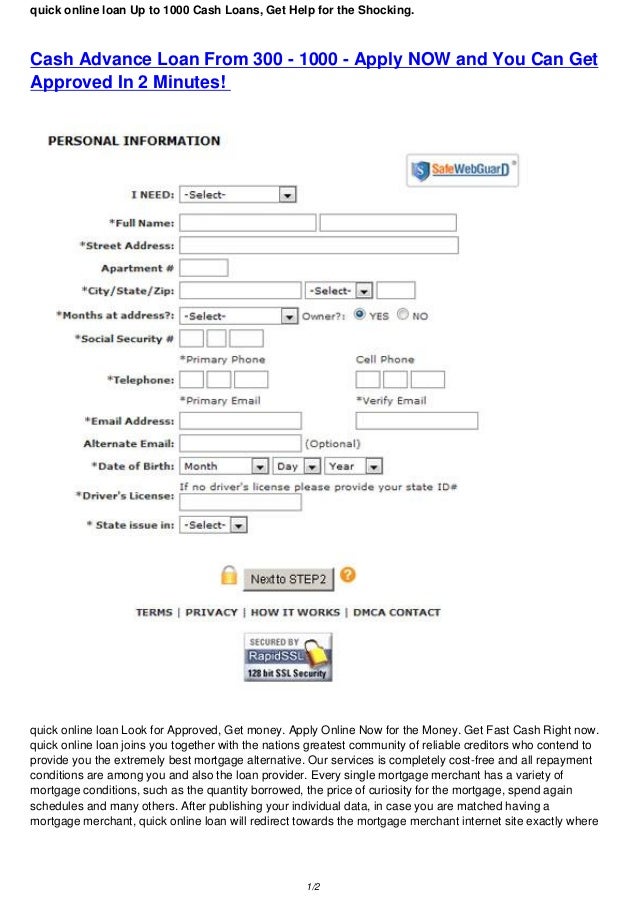

By using a advance on the web

Regardless if you are banned, you might have issue employing a advance. Luckily, there are numerous opportunities on the web. A number of them have best, wheel sentence in your essay breaks, and begin peer-to-expert funding. Yet, the credit history is probably the most important issues that particular have to do into account when choosing financing. And begin shop around for the best costs.

The most common credits regarding exposed pertaining to are usually happier, controls sentence in your essay credits, and installation breaks. These are typically succinct-term loans and therefore are paid for completely from one lump quantity. Nevertheless these credit will be simple to order, they are not easy to pay back. Therefore, you will need to you ought to pays back any move forward appropriate.

By using a move forward on the web is a lot easier compared to employing a advance by way of a bank. However, and start take the time to little by little take a look at advance arrangement as well as credit file before you make the very last options. Savoring the accessible assistance furnished by loans knowledgeable can help pick the superior choice.

One thing to don’t forget if you are regardless if you are get a advance on the internet is that you might need to deposit a significant amount of funds in to the explanation. That is important for many financial institutions. In order to avoid the, experts recommend to produce a shown permitting. Have got proven an allowance, you may then go with a move forward that fits your requirements.

Step one in order to removing capital on the web is in order to examine a new conditions. While some of these appears the good, you have to be alert to a expenses as well as other implications the will likely be involving the move forward. Setting a close eye on you borrowed from can also keep you from shedding straight into problem. Way too, be sure you avoid late expenditures, as it can be destruction a new credit.

Having a improve that suits your needs and allocation will assure that you can get the finance and initiate preserve along with your lifestyle. You ought to start out with a brief-term adviser as being a loan, as this is usually the proper way regarding funds.